The Dow's Losses in Real Terms Picks Up Steam

It appears that the run in the Dow Jones is out of steam and it is now time to rotate into commodities - namely, gold and silver.

Read article

It appears that the run in the Dow Jones is out of steam and it is now time to rotate into commodities - namely, gold and silver.

Read article

Since the crisis in 2020, the US stock market has grown at a sustained rate of +20% per year. Since 2022, this rise has been further accentuated by the rise of artificial intelligence. Despite the momentum of innovation and continued growth in the US, the strength of this bull market is raising q...

Read article

Apparently Trump’s motto is: Go big or go home. Gold at $2,900 values the US’s 8,100 tonne at a measly $0.8 T. Do you really think he’s going to tweak the monetary system to put a lousy $0.8 trillion onto the balance sheet?

Read article

Are we witnessing the end of paper gold? Currently, 100 ounces of paper gold are traded for every ounce of physical gold available on the market. If paper gold investors lose confidence in their counterparties against a backdrop of physical metal shortages, we'll be witnessing a historic event in...

Read article

The price of gold in South Korea rose sharply, fuelled by a “fear of missing out” (FOMO) rush. In response to this strong demand, South Korean banks suspended the sale of gold and silver bars, citing a shortage.

Read article

The gold market is becoming more physical, less manipulated and more transparent. The rush to buy physical gold is taking place against a backdrop of rising inflation.

Read article

Gold is the barometer of current events, and as such, it sends out a very strong signal. At a time when the global economy is reeling under the effects of financial instability, trade wars and geopolitical conflicts, the yellow metal is racking up record after record.

Read article

As gold makes yet another All Time High this week and now sets its sights on $3,000, silver remains in the low-$30s with investors left wondering just if and when the metal will start to move. This week, we'll take a look at a couple of ratio charts that will renew your enthusiasm for silver.

Read article

Until recently, physical gold used to flow mainly from refineries to the BRICS countries. Now, over the past two months, it's the US market that's acting as a veritable vacuum cleaner, absorbing an ever-increasing share of the physical gold market.

Read article

There is an argument against buying gold that really ticks me off (and the same goes for bitcoin): it offers no return, no interest and no dividend, unlike conventional investments (stocks, bonds, life insurance, bank savings accounts, rental property). It would be a second-rate asset, imperfect...

Read article

Since the announcement of Trump’s victory, the COMEX has been facing exceptionally high Gold delivery demands.This required a veritable airlift to transfer 393 tonnes of gold from the LBMA’s London warehouses to the COMEX vaults in New York, bringing the New York gold stocks to 926 tonnes. This m...

Read article

Physical gold is no longer simply an investment; it is now the ultimate protection, ensuring the smooth running of the economy in the event of a sudden breakdown in the traditional financial system.

Read article

This week, we'll look at medium-term charts of Silver/Euro and Silver/FTSE.

Read article

Physical gold now plays the same role in the United States as it did in China last year: a safe alternative in the face of economic and financial instability.

Read article

Traditional portfolios, divided between equities and bonds, are less resilient to economic shocks than they used to be, as the two assets increasingly react in tandem, reducing their diversification and resilience. Another asset must therefore be included: physical gold.

Read article

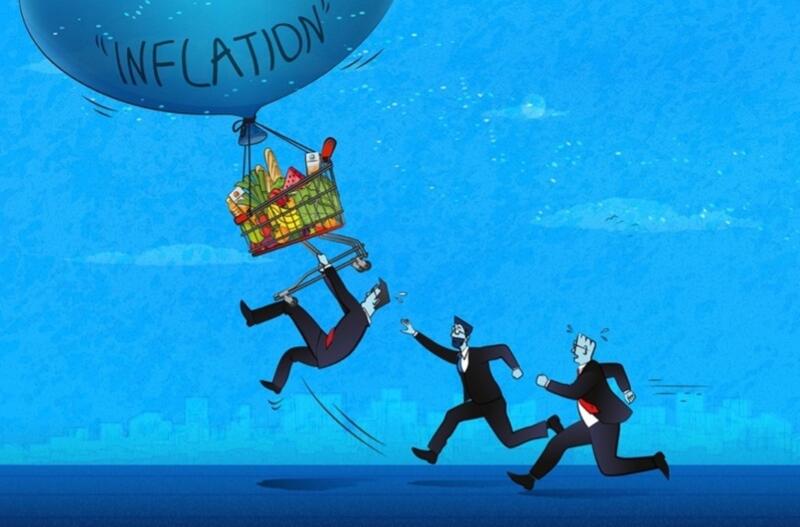

After successive interest rate hikes, prices finally seem to be slowing down, but there are still many uncertainties. So can we look forward to a return to normal, or should we expect a new economic reality marked by high inflation?

Read article

This week, we'll change things up from our usual analysis on longer term charts and instead focus on the short term to see if there are any clues about where gold and silver are headed next.

Read article

By bolstering its gold reserves, China is anticipating the risks of a weakening dollar, linked to budgetary pressures and possible monetary expansion needed to absorb the debt wall.

Read article

With 2024 now behind us, the year ahead promises to be all the more dramatic. The times in which we live remain historically intense. At this very particular moment when two worlds are separating, the decades to come are being written today. 2025 will therefore be marked by the accelerated develo...

Read article

The year 2025 is off to a rough start for the sovereign debt market. Is the resurgence of inflation driving interest rates higher? In Europe, manufacturing activity is slowing, weakening employment, while in the United States, declining orders and consumption are heightening the risks of a global...

Read article